Starting Up Your Business in Osaka: Introduction

Entering the Japanese Market (Type of Business)

Ordinarily, a foreign enterprise enters the Japanese market using one of the following 4 corporate structures:

- Representative office

- Branch (in Japanese legally known as “Gaikokugaisha no nihon ni okeru eigyousho (a business office of foreign company in Japan)” hereinafter called “Branch”).

Under the Japanese Corporate Law there are 2 types of branches; those which have a business office in Japan and those which do not. Branch in this pamphlet shall mean a branch which has a business office in Japan. ) - Japanese Corporate Entity (Kabushiki Kaisha (KK) or Godo Kaisha (LLC))

- Limited Liability Partnership; LLP

Prior notification to Minister of Finance and Competent Minister through the bank of Japan is required for certain inward direct investment, etc. for security purpose, etc. based on the Foreign Exchange and Foreign Trade Law (hereinafter “Foreign Exchange Law”), and there is a case where change of the content of the investment or cancellation is recommended as a result of the examination.

The following cases are subject to prior notification:

(1) If the nationality or located country (including region) of foreign investor is country/region other than Japan or listed country in Appended Table 1 of “Order on Inward Direct Investment” (174 countries/region as of December 2020).

(2) If the business operated by the company to be invested includes any business belonging to designated industries (business types specified by the Minister of Finance and the minister having jurisdiction over the business pursuant to the provision of Article 3, paragraph (3) of the Order on Inward Direct Investment, etc.)

1. Representative Office

In general, a foreign enterprise is free to establish a representative office in Japan for the purpose of collecting and providing information. As such, no permission, notification or registration is required for the establishment of such an office under the Foreign Exchange Law. Since the representative office cannot conclude contracts, it is therefore not subject to Japanese corporate tax.

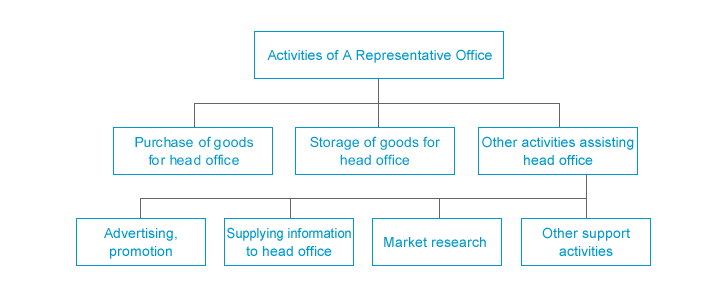

Chart1:Ordinary Activities of a Representative Office

The banks in Japan do not allow representative offices to open bank account in the name of foreign companies. If any representative office in Japan intends to conduct activities other than those listed in the above chart, it must, regardless of its title, implement the procedures necessary to establish a branch or a Japanese corporate entity.

2. Branch

(1) Branch Registration

When a foreign company intends to engage in business on a continuous basis in Japan, it is necessary to appoint a representative in Japan and to have such person registered, as specified in Article 817 and Article 818 of the Corporate Law. Many foreign companies intending to conduct business with Japanese companies establish a business in Japan, which is generally registered as a branch in Japan. This registration enables the applicant to obtain a commercial register certificate from the Legal Affairs Bureau, which is evidence of existence as a corporate entity in Japan and makes it possible to open a corporate bank account at a commercial bank.

To apply for registration of a branch, Article 129 of the Commercial Registration Law requires the following documents to be submitted:

- Document evidencing the existence of the applicant’s head office (such as a certified copy of the commercial register in the home country)

- Document certifying the competency of the representative in Japan

- Articles of incorporation of the applicant or such documents as are sufficient to show the business objectives of the applicant

- Document certifying the method of public notice as a foreign company, if such a method exists

The above documents must be attested to by the competent authorities, such as the consul residing in Japan or a notary public of the applicant’s home jurisdiction, etc. It is also possible to apply for registration with such documents attested to by the competent authorities, by affidavit or the like, describing the information required in “1)” to “4)” above.

Registered Branch Manager (legally known as "Representative in Japan") represents the branch and is authorized to conduct business with third parties without headquarters’ internal approval (excluding the cases of existence of an agreement between headquarter and branch which prescribing that headquarters’ internal approval is required to conduct business with third parties). However, a change of registration, such as the resignation of Representative in Japan, the appointment of a new Representative in Japan, etc., must be done in each case. Based on the Foreign Exchange Law, “Notification concerning the Establishment of a Branch, etc.” is not required except for the cases where the business operated by the company to be invested includes designated industries. (In the cases where such designated industries are included, “Notification concerning the Establishment of a Branch, etc.” shall be submitted to the Minister of Finance and other competent Ministers through the Bank of Japan within the period of 6 months preceding the date of establishment).

(2) A general flow of procedure for registering establishment of a branch

3. Japanese Corporate Entity (Kabushiki Kaisha (KK) or Godo Kaisha (LLC))

If the foreign enterprise incorporates a Japanese corporation, it is treated as a “Direct Domestic Investment” under the Foreign Exchange Law. The enterprise is required to submit notification of its incorporation to the Minister of Finance and other competent Ministers through the Bank of Japan within 45 days from the date of registration(prior notification may also be required in some cases).

Under the Corporate Law, companies are broadly classified into two types according to shareholders’ responsibilities and governance. One type is Kabushiki Kaisha (stock company) and the other is Equity Companies (joint-name company/ joint-fund company/ limited liability company).

- A stock company (Kabushiki Kaisha, KK) consists of shareholders whose liabilities to creditors of the company are limited to the amount of stock purchased in the company.

- A joint-name company (Gomei Kaisha) consists of partners whose liabilities to creditors of the company are unlimited.

- A joint-fund company (Goshi Kaisha) consists of limited and unlimited partners. Limited partners’ liabilities to the creditors of the company are limited to the amount of their contribution to the company.

- A limited liability company (Godo Kaisha, LLC) consists of partners whose liabilities to creditors of the company are limited.

It is necessary to acquire independent corporate status in Japan and to establish the legally required officers (institution) or representatives when incorporating. There are two corporate structures that a foreign investor can assume with limited liability; a stock company (Kabushiki Kaisha) and a limited liability company (Godo Kaisha, LLC). The other structures specified in the Company Law are a general partnership (Gomei Kaisha) and a limited partnership (Goshi Kaisha), designed for small-scale companies. However, since Gomei Kaisha and Goshi Kaisha require members with unlimited liability, they seem to be seldom utilized by foreign companies for investments in Japan.

(1) Kabushiki Kaisha

The Corporate Law does not require minimum capital for a Kabushiki Kaisha at the time of incorporation. Accordingly, a Kabushiki Kaisha can be established even with a ¥1 investment. On the other hand, the Corporate Law prohibits dividends distribution unless its net assets are ¥3,000,000 or more.

A Kabushiki Kaisha is classified into Large Company or Company which is not a Large Company (hereinafter called “Small-Medium Company”) by its amount of capital or liability, and Public Company or a Company which is not a Public Company (hereinafter called “Nonpublic Company”) by transferability of stock.

| Large Company (LC) | The capital is ¥500 million or more Or total liability is ¥20 billion or more |

|---|---|

| Small-Medium Company (SMC) | Other than Large Company |

| Public Company | Transfer of all or part of shares to be issued does not require the company’s consent |

| Non-public Company | Transfer of every class of shares to be issued requires the company’s consent |

Under the Corporate Law, the internal organization structure such as director/representative director, board of directors, statutory auditors and accounting counselor can be more flexibly designed depending upon the type of Kabushiki Kaisha.

(2) A general flow of procedure for registering the incorporation of a stock company (Kabushiki Kaisha)

The following is the necessary procedure for foreign investor(s) for establishment of Kabushiki Kaisha. (There are 2 ways, Hokki-setsuritsu and Boshu-setsuritsu, for company establishment stipulated by the Corporate Law. The following outlines the method of incorporation through the Hokki-Setsuritsu; incorporation by subscription of all shares by the promoters.)

(It is acceptable that all the initial directors’ address is outside of Japan.*Note 2*)

*Note 1*

- Name of Bank Account Holder

Payment of the capital subscription into a Japanese bank account, etc., specified by the promoter is required upon establishment of Kabushiki Kaisha. If a big foreign enterprise is a promoter, it is possible to make a payment into a separate deposit account (betsudanyokinkoza) at a commercial bank in Japan. However, since it generally is difficult to open a separate deposit account (betsudanyokinkoza) for investment by small/medium foreign enterprises or individuals, such investors shall make payment into “a personal bank account of the initial representative director” as a bank account, etc., specified by the promoter.

However, third person’s bank account (including corporation) other than promoter and representative director upon incorporation is acceptable only when all promoters and directors upon incorporation are non-resident in Japan, as an exception. (Circular notes No. 41 of Civil Affairs Bureau, the Commercial Affairs Division dated March 13, 2017)

In this case, promoter’s power of attorney is required to be attached to company establishment registration documents.

- Institution Handling Payments

Not only head office and branch offices of Japanese domestic bank but also branch offices of the foreign banks in Japan (the banks established by permission of the Prime Minister) are included as “institution handling payments”. Further, overseas branch offices of Japanese domestic bank are included as “institution handling payments”. (Circular notes No. 179 of Civil Affairs Bureau, the Commercial Affairs Division dated December 20, 2016)

*Note 2*

Residence of Representative Director of a Company

Requirement that at least one representative director of Japanese domestic company must have a residential address in Japan was abolished. Therefore, registrations of company establishment only with non-resident representative directors, and appointment or re-appointment of such directors are acceptable. (Notification No. 29 of Civil Affairs Bureau, the Commercial Affairs Division dated March 16, 2015)

Even if all representative directors live outside of Japan, it is possible to apply for registration of company establishment in Japan (No needs to be Japanese.)

(3) Limited Liability Company :LLC (Godo Kaisha)

In principal, investor(s) of Godo Kaisha shall individually execute business and represent the company. That means that owner(s) (investor(s)) of Godo Kaisha shall manage a company. However, it is possible that some of investors shall execute business and select a representative among from such executive investors. Despite its name “Godo (joint)” Kaisha, Godo Kaisha can be established with even only 1 investor. Godo Kaisha is similar to LLC (Limited Liability Company) in U.S., which is a combination of limited liability of investors and flexible business structure. However, Godo Kaisha is subject to corporate income tax since Godo Kaisha is a corporate entity. Therefore, it should be noted that treatment by the tax law for Godo Kaisha is different from that of LLC in the U.S.

(4) A general flow of procedure for incorporation of a limited liability company: LLC (Godo Kaisha)

Because of the legal issues associated with the formation and registration of a Kabushiki Kaisha or Godo Kaisha, legal advice and assistance by specialists should be sought.

4. Limited Liability Partnership: LLP (Yugen Sekinin Jigyo Kumiai)

(1) Features of LLPs

LLPs may be formed in a case where research institute such as university licenses technology and other partner such as corporate entity, etc. contributes funding to start a new business.

Registration is made according to the location of the main office in accordance with certain prescribed rules. However, please note that an LLP cannot be reorganized into a company such as Kabushiki Kaisha.

(2) A general flow of procedures for establishment of a limited liability partnership: LLP (Yugen Sekinin Jigyo Kumiai)

5. Comparison of a stock company (Kabushiki Kaisha), limited liability company (LLC) and limited liability partnership (LLP)*

| Structure | Stock Company (Kabushiki Kaisha) |

Limited Liability Company |

Limited Liability Partnership |

|---|---|---|---|

| Corporate status | Yes | Yes | No |

| Capital contribution (can be both corporation or individual) |

Stockholders (one or more investors) |

Members with limited liabilities (one or more investors) |

Partners with limited liabilities (two or more investors) |

| Legally required organization(s) |

General meeting of stockholders, directors | (Consensus of members) | (Consensus of partners) |

| Executive officer | Representative director, etc. | Executive member | Executive partner |

| Capital (*1) | No restriction on monetary amounts | No restriction on monetary amounts |

No restriction on monetary amounts (Contributed amount shall not be registered) |

| Equity transfers | Generally free | Approval of members | Approval of partners |

| Modification of articles of incorporation |

Special resolution at a general meeting of stockholders | Agreement of all members |

Agreement of all partners |

| Registration | Required | Required | Required |

| Taxes levied on member(s) (subject to each investor's individual income) |

No | No | Yes |

| Existence with a single member |

Possible | Possible | Not possible |

| Reorganization into different corporate structures |

Possible | Possible | Not possible |

| Merger with another joint stock company (Kabushiki Kaisha) |

Possible | Possible | Not possible |

*Stock company (Kabushiki Kaisha); limited liability company: LLC (Godo Kaisha:);

limited liability partnership: LLP (Yugen Sekinin Jigyo Kumiai)

* 1 Stock company (Kabushiki Kaisha) and LLC (Godo Kaisha) can be established with capital of 1 yen or more. However, based on Immigration Regulation, etc., minimum 5 million yen or more investment may be required in order to acquire residential status as business manager for non-Japanese after establishment of company.

Pros and Cons of Each Structure

| Corporate Entity or LLP | Pros | Cons |

|---|---|---|

| Kabushiki Kaisha | • Generally, Kabushiki Kaisha is the most popular corporate entity in Japan • Many of the Japanese big corporations are Kabushiki Kaisha |

• Minimum amount of registration tax is 150,000YEN, which is higher than other structures. •Third person’s bank account other than promoter and representative director upon incorporation is acceptable only when all promoters and directors upon incorporation are non-resident in Japan as an exception, however, foreign individuals or small sized foreign companies who do not have Japanese partners in Japan often have difficulty in opening company bank account after establishment. |

| Limited Liability Company (Godo Kaisha) |

When compared with Kabusihki Kaisha, Godo Kaisha has advantages that: i) payment into a bank account is not required for capital investment; ii) minimum amount of registration tax for company establishment is 60,000YEN, which is lower than Kabushiki Kaisha (Registration tax for Kabushiki Kaisha is 150,000JPY). | • Not so many Japanese know existence of “Godo Kaisha”. • Unlike LLC in U.S., Japanese LLC (Godo Kaisha) is subject to Corporate Income Tax. |

| LLP | Distribution amount can be decided freely between a partner who licensed technology and a partner who contributed funding by negotiation. | • Entity conversion from LLP to corporate Entity is impossible. |

6. Sample calculations of the costs of establishing a business in Japan

The following section gives examples of costs (in yen) incurred in the establishment in Japan of a branch office, a stock company (Kabushiki Kaisha), a limited liability company (LLC) or a limited liability partnership (LLP) by non-Japanese on the assumption residential status as a business manager is acquired. It should be noted that the amounts, etc. indicated here may vary, depending on different circumstances.

| Document submitted to | Branch | Joint Stock Company | Limited Liability Company: LLC | Limited Liability Partnership: LLP | ||

|---|---|---|---|---|---|---|

| Consultation on registration | Consultation on commercial registration | Legal Affairs Bureau | Free of charge | Free of charge | Free of charge | Free of charge |

| Professional advice on incorporation, etc. | Professional (Fees will vary, depending on the professional services chosen, but the figures shown here are benchmarks for one session (about one hour).) |

10,000 | 10,000 | 10,000 | 10,000 | |

| Registration expenses | Revenue stamp (for articles of incorporation) |

Not necessary | 40,000 (However, not necessary if notarized electronically ) |

40,000 (However, not necessary if notarized electronically) |

Not necessary | |

| Charge for notarization of the articles of incorporation | Notary public's office | Not necessary | 50,000 | Not necessary | Not necessary | |

| Charge for issuing a certified copy of the articles of incorporation | Not necessary | 2,500 (250 yen/copy×5× 2 sets) |

Not necessary | Not necessary | ||

| Certificate of registered seal *1 | Not necessary | 300 | Not necessary | Not necessary | ||

| Legal Affairs Bureau | 300 | 300 | 300 | 600 | ||

| Registration tax*2 | 90,000 | 150,000 | 60,000 | 60,000 | ||

| Certified copy of the commercial register | 3,000 (600yen/copy × 5) |

3,000 (600yen/copy × 5) |

3,000 (600yen/copy × 5) |

3,000 (600yen/copy × 5) |

||

| Corporate representative seal | 10,000 | 10,000 | 10,000 | 10,000 | ||

| Certificate of registered representative seal | 900 (450 yen/copy × 2) |

900 (450 yen/copy × 2) |

900 (450 yen/copy × 2) |

900 (450 yen/copy × 2) |

||

| Affidavit or notarization (original and Japanese translation) |

Varies depending on home country | Not necessary | Not necessary | Not necessary | ||

| Confirmation of official approvals and licenses (Varies depending on category of business) |

National and prefectural governments | ― | ― | ― | ― | |

| Official notification in accordance with the Foreign Exchange Law | Bank of Japan | ― | ― | ― | ― | |

| Professional commissions for registration expenses, confirmation of approvals/licenses, and notification required by the Foreign Exchange Law

(Varies depending on professional services) |

Professionals | 250,000 | 250,000 | 250,000 | 250,000 | |

| total | 364,200 | 517,000 | 374,200 | 334,500 | ||

*1 A certificate of each promoter ’s registered seal is required at the notary public's office. In the event the promoter is a corporation, a certified copy of the commercial register and a certificate of the registered seal of the corporate representative shall be required. In the case of a foreign nonresident, a certificate of the signature (attested to by a notary public ’s office in the home country), instead of a certificate of the registered seal shall be required.

A certificate of a registered seal must have been issued within the previous three months by a local government office.

*2 The registration tax for a joint stock company or a limited liability company shall be 7/1000 of the paid-in capital. However, the minimum registration tax shall be 150,000 yen for a stock company(Kabushiki Kaisha) and 60,000 yen for a limited liability company.